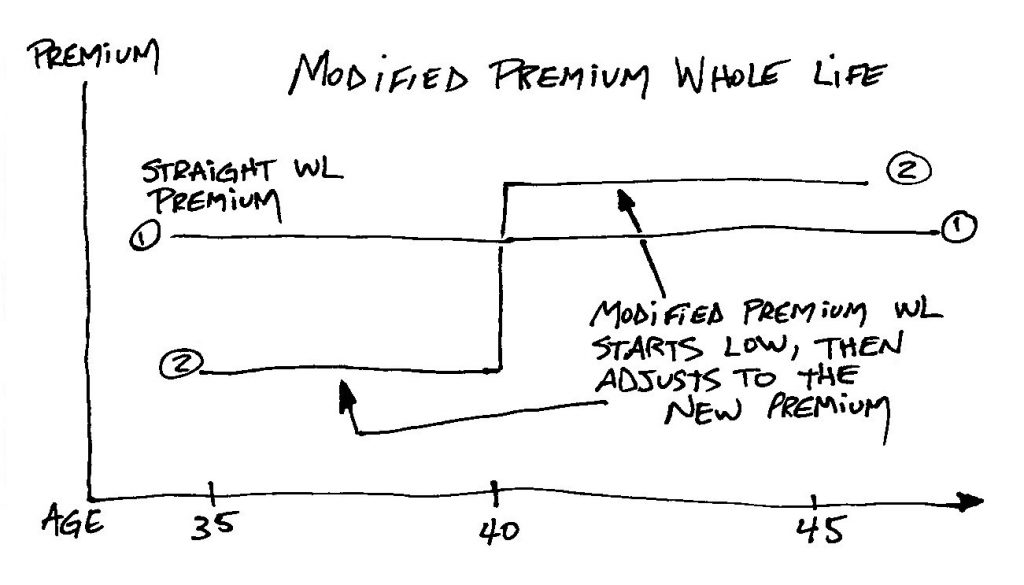

Modified whole life insurance is a type of permanent life insurance with an initial period of lower premiums. Following this period, premiums increase to a standard rate.

When seeking a life insurance plan that combines lifelong coverage with initially low payments, modified whole life insurance stands out as a practical option. This policy structure is designed to accommodate individuals who anticipate a rise in income over time, allowing them to manage costs effectively in the early years.

The premiums are adjusted after the initial phase, aligning with typical whole life insurance payments. It’s essential for policyholders to plan for the future rate increase to maintain coverage continuity. As a form of life insurance, it also offers the standard benefits such as a guaranteed death benefit and potential cash value accumulation, making it a dual-purpose financial tool for both estate planning and income security for beneficiaries.

Introduction To Modified Whole Life Insurance

Modified Whole Life Insurance stands out among life insurance products. This unique policy adjusts to fit life’s changing financial demands. It offers a blend of lifelong coverage and changing premium costs. Understand this policy to determine if it aligns with your insurance objectives.

Features Of A Modified Whole Life Policy

- Guaranteed Lifetime Coverage: Ensures protection doesn’t expire.

- Modified Premium Structure: Lower premiums initially, then a shift to higher rates.

- Cash Value Accumulation: The policy builds cash over time, adding a savings element.

- Fixed Death Benefit: Beneficiaries receive a set amount, regardless of policy duration.

Contrast With Standard Whole Life Insurance

| Aspect | Modified Whole Life | Standard Whole Life |

|---|---|---|

| Premiums | Start lower, increase later | Consistent throughout |

| Target Audience | Those with limited current funds | Seekers of stable premium rates |

| Cash Value Growth | Slower in early years | Steady over time |

| Policy Focus | Balancing costs with life stages | Long-term financial stability |

Premium Structure Explained

Understanding the premium structure of Modified Whole Life Insurance helps in planning finances. It is vital to know how premiums change over time. This section breaks down the premium structure to aid clarity on what to expect when opting for Modified Whole Life Insurance.

Initial Lower Premiums

Many choose Modified Whole Life Insurance for its affordable start. During the policy’s initial years, premiums stay low. This initial period, typically several years, makes the policy attractive for budget-conscious individuals. It is a cost-effective way to obtain coverage early on.

Scheduled Premium Increases

After the initial period, expect regular premium increases. These rises are outlined in the policy agreement. Understanding these changes assures there are no surprises. It helps in preparing finances for the future.

- Predictable increments: Scheduled increases means no guessing games.

- Budget planning: Allows for future financial planning.

Long-term Cost Implications

In the long run, Modified Whole Life Insurance might incur higher costs. It’s important as premiums escalate. Staying informed ensures understanding of the total investment in the policy over time.

| Time Period | Premium Cost |

|---|---|

| Initial Years | Low |

| Post-Initial Years | Higher |

| Long-Term | Highest |

Reviewing the policy’s full length helps in understanding the financial commitment required.

Benefits And Drawbacks

Modified Whole Life Insurance is a unique type of policy. It has specific benefits and drawbacks. Understanding these can help you make an informed choice.

Affordability For Younger Policyholders

Young people might find this insurance appealing. Its starting premiums are lower than traditional whole life policies. This makes it more accessible for those in the early stages of their career.

Potential For Higher Lifetime Cost

However, the initial savings may be misleading. Over time, the premiums can increase. This means the total cost over a lifetime could be higher than regular whole life insurance.

Impact On Cash Value Accumulation

Modified Whole Life Insurance also affects cash value growth. The cash value grows more slowly because of the lower premiums in the early years. This can impact the long-term benefits of the policy.

Let’s weigh these factors in detail:

| Benefit/Drawing | Details |

|---|---|

| Early Affordability | Easier on the wallet for young policyholders |

| Lifetime Cost | May cost more in the long run versus level premium policies |

| Cash Value Growth | Slower accumulation could affect loan or withdrawal possibilities |

- Early affordability increases attractivity.

- A higher lifetime cost must be considered.

- Cash value growth can be limited.

Credit: decisiontree.financial

Who Should Consider Modified Whole Life Insurance?

Life is unpredictable and planning for the future is a must. One wise choice for long-term financial security is modified whole life insurance. This insurance adapts to your budget, offering lower premiums initially. It ensures peace of mind for you and your loved ones. Below are specific groups who might benefit from considering this type of insurance plan.

Financial Planning For Young Families

Young families often work with tight budgets. They have unique financial demands such as:

- Childcare costs

- Educational funds

- Home loans

With modified whole life insurance, your family can have a safety net. This insurance is a fitting piece in your financial puzzle.

Considerations For Individuals With Variable Income

For those with inconsistent earnings, budgeting is a juggling act. You need a plan that adapts to your cash flow. Modified whole life insurance checks this box. It allows:

- Initial lower premium payments

- Flexibility for future income fluctuations

- Guaranteed coverage despite income changes

Think of it as a financial lifeline through seasons of income uncertainty.

Case Studies And Real-world Applications

Exploring how Modified Whole Life Insurance works in real settings shines light on its strengths and areas for caution. Real-life scenarios reveal the practicality of such policies. Success stories can inspire, while struggles offer valuable insights.

Success Stories Of Using Modified Whole Life

Examples abound where Modified Whole Life Insurance has been a financial boon. Consider the instance of a family that leveraged the policy’s graded death benefit. In Year 3, when the policy’s full coverage kicked in, the benefit was a welcome relief during a tragic loss.

- Maria, a single mother, found financial stability for her children with her policy.

- John, who was previously uninsured, benefited from the lower initial premiums of a Modified Whole Life policy.

- Retired couple, Susan and Bob, used their policy’s cash value for an unexpected medical expense.

These stories highlight the security Modified Whole Life Insurance can add to varied lives.

Pitfalls And Lessons Learned

Risks are part of any financial decision. Modified Whole Life Insurance is no exception.

- James signed up without reviewing the policy’s terms. The rising premiums became hard to manage after retirement.

- Linda realized the initial low coverage affected her loan eligibility. Her policy did not offer enough security at first.

- Kevin chose Modified Whole Life without comparing it to other insurance products. Later, he found term life insurance would have been a better fit.

Learning from these cases is crucial. Always review the full terms and keep an eye on long-term costs and benefits. Consult a financial advisor to ensure a policy fits personal needs.

Credit: wealthnation.io

Making An Informed Decision

Making an Informed Decision on Modified Whole Life Insurance means understanding your options. This product can offer lifelong coverage with potentially lower premiums at the start. Yet, navigating the intricacies of these policies requires careful thought. Comparing options and asking the right questions can ensure the choice aligns with your financial goals.

Comparing Policies And Providers

Life insurance is a commitment. Weighing the features of different policies is crucial:

- Assess coverage limits and premium changes over time.

- Research company reputations and customer satisfaction.

- Examine additional benefits or riders included.

Use tools like comparison charts to visualize differences:

| Feature | Policy A | Policy B |

|---|---|---|

| Start Premium | $40/month | $35/month |

| Coverage Limit | $100,000 | $100,000 |

| Customer Ratings | 4.5/5 | 4.0/5 |

Questions To Ask Before Purchase

Key questions unlock the best policy for your needs:

- How will my premiums change over time?

- What happens if I miss a payment?

- Is there a cash value component?

Understanding policy details means fewer surprises down the road.

The Role Of Financial Advisors

Guidance from financial advisors can clarify complexities:

- Personalized Analysis: Tailor policies to fit your financial status.

- Long-term Strategies: Integrate insurance into your broader financial plan.

- Clarification: Explain terms and conditions in simple language.

Select a trusted advisor to ensure a solid insurance footing.

Credit: www.westernsouthern.com

Frequently Asked Questions Of Modified Whole Life Insurance

What Is A Modified Whole Life Policy?

A modified whole life policy combines permanent coverage with initially lower premiums that increase after a set period. It provides lifetime insurance protection with cost adjustments over time.

Can You Cash Out A Whole Life Insurance Policy?

Yes, you can cash out a whole life insurance policy. This is done through a policy loan or surrender, whereby you receive the policy’s cash value minus any surrender charges.

Why Is Whole Life Insurance A Money Trap?

Whole life insurance often involves high premiums and complex terms, leading to more costs than benefits. Investments may offer better returns, leaving whole life policies as less optimal financially.

What Are The Three Types Of Whole Life Policies?

The three types of whole life policies are traditional whole life, universal life, and variable universal life. Each offers permanent coverage with varying payment and investment options.

Conclusion

Navigating the realm of life insurance can be daunting, yet essential for securing financial stability for your loved ones. Modified whole life insurance stands out as a flexible, enduring option. It merges lasting coverage with adaptable premiums, shaping a tailored fit for diverse fiscal scenarios.

Embrace the peace of mind that comes with a well-chosen policy—consider the modified plan as a key component in your financial portfolio.