To invest life insurance money wisely, consider a mix of low-cost index funds and diversified ETFs for long-term growth potential. This approach helps maximize returns while managing risk effectively.

Life insurance payouts can secure your financial future when invested strategically. By diversifying your investment portfolio, you can create a stable foundation for wealth accumulation and protect your loved ones financially. Being intentional and informed about where you allocate your life insurance funds can yield substantial benefits in the long run, providing peace of mind and stability for you and your family.

Partnering with a financial advisor for personalized guidance can further enhance your investment strategy, ensuring a tailored approach that aligns with your goals and risk tolerance.

Credit: topwholelife.com

Understanding Life Insurance Payouts

Upon receiving a life insurance payout, carefully consider different investment options to maximize its potential. Investing in stocks, bonds, or real estate can provide long-term growth and financial stability for your loved ones. Diversifying your investments ensures a balanced and secure approach to managing the insurance funds.

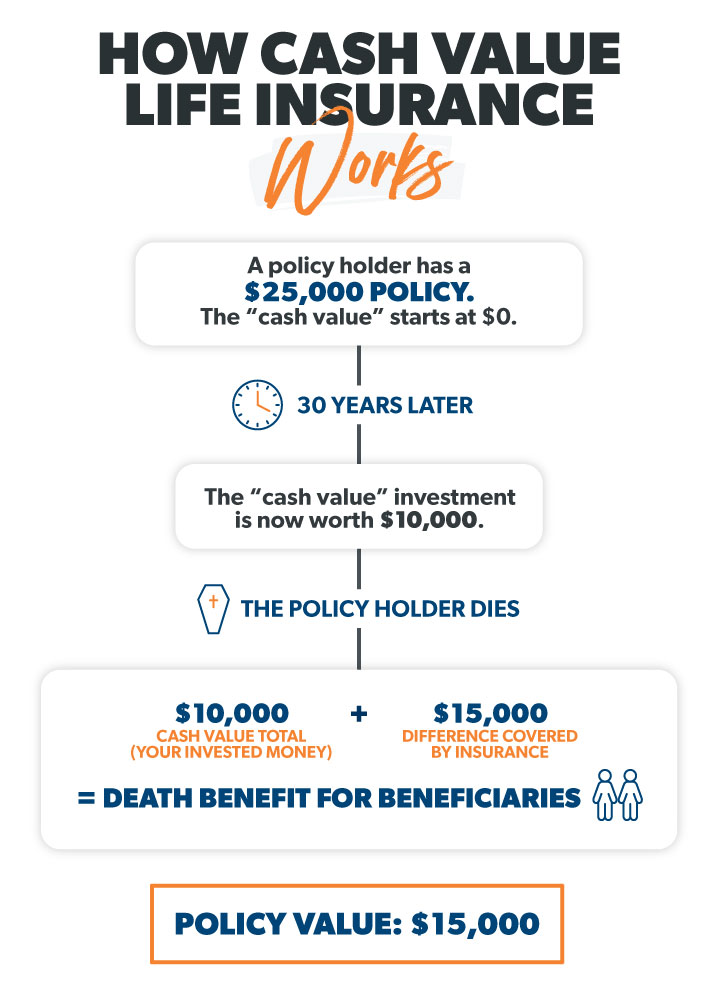

Understanding Life Insurance Payouts Life insurance payouts play a crucial role when it comes to utilizing the money received from a life insurance policy. These payouts provide financial support to the policyholder’s beneficiaries upon their passing. To make the most out of your life insurance money, it is essential to have a solid understanding of how these payouts work. In this section, we will explore the different types of life insurance policies as well as the factors that can affect the payout amount. Types of Life Insurance Life insurance policies can be broadly classified into two main types: term life insurance and whole life insurance. 1. Term Life Insurance: – Provides coverage for a specific period, commonly 10, 20, or 30 years. – Offers a death benefit to the beneficiaries if the insured individual passes away during the policy term. – Generally has lower premiums compared to whole life insurance. 2. Whole Life Insurance: – Offers lifelong coverage, as long as the premiums are paid. – Combines a death benefit with a cash value component. – Typically has higher premiums than term life insurance. Factors Affecting Payouts Several factors can influence the payout amount your beneficiaries receive from a life insurance policy. It is important to consider these factors when making investment decisions. 1. Policy Type and Coverage: – The type of life insurance policy you choose can significantly impact the payout amount. – Term life insurance policies usually pay the face value as the death benefit. – Whole life insurance policies provide both a death benefit and a cash value that can grow over time. 2. Premiums Paid: – The premiums you pay for your life insurance policy can affect the payout. – Paying higher premiums can increase the death benefit and the cash value of a whole life insurance policy. 3. Policyholder’s Health: – The policyholder’s health condition and medical history can impact the premium amount and potential payout. – Generally, individuals with better health may qualify for lower premiums and higher death benefits. 4. Policy Terms and Riders: – The terms of the policy, such as the length of coverage and any additional riders, can affect the payout amount. – Riders, such as accidental death benefits or critical illness riders, can provide additional coverage for specific situations. 5. Outstanding Loans or Debts: – If there are outstanding loans or debts against the policy, the payout amount may be reduced accordingly. – It is crucial to consider these financial obligations when determining the best way to invest the life insurance money. Understanding how life insurance payouts work and the factors influencing them is vital in making informed decisions about investing the money received from a life insurance policy. Whether it’s considering the type of insurance or analyzing the various factors that can affect the payout amount, being well-informed ensures that you optimize the benefits of your life insurance investment.

Immediate Financial Needs

Looking for the best way to invest your life insurance money? Consider your immediate financial needs and explore investment options that align with your long-term goals. Whether it’s starting a business, investing in stocks, or real estate, make sure to assess your risk tolerance and seek professional advice for a smart investment strategy.

Covering Funeral Expenses

Life insurance money can help cover funeral expenses immediately.

- Meet the funeral costs without financial strain.

- Ensure a dignified send-off for your loved one.

- Relieve the financial burden on family members.

Paying Off Debts

Use life insurance funds to pay off debts promptly.

- Settle outstanding debts quickly and efficiently.

- Avoid accumulating interest on unpaid debts.

- Secure financial stability for your beneficiaries.

Long-term Financial Security

Setting aside life insurance money for education helps secure the future of your loved ones.

Building an emergency fund ensures financial stability during unforeseen circumstances.

Credit: www.ramseysolutions.com

Estate Planning And Inheritance

When deciding how to invest life insurance money, consider estate planning and inheritance strategies. Utilize expert guidance to ensure wealth preservation and seamless wealth transfer for future generations. Plan thoughtfully to maximize the benefits of life insurance proceeds.

Legacy Planning

Legacy planning is an essential aspect of estate planning, ensuring that your life insurance money is used to create a lasting impact for future generations. It involves carefully thought-out decisions that determine how your wealth and assets will be distributed after your passing. By taking proactive steps today, you can ensure that your loved ones are provided for and that your legacy is preserved.

One of the most effective ways to plan your legacy is by creating a will, which serves as a legally binding document that outlines your wishes regarding the distribution of your assets. A will allows you to specify the beneficiaries of your life insurance money, ensuring that it goes to the individuals or organizations you wish to support.

Additionally, considering the establishment of a trust can further enhance your legacy planning efforts. A trust is a legal entity that holds and manages your assets on behalf of designated beneficiaries. By setting up a trust, you can maintain control over how your life insurance money is utilized, even after your passing.

Tax Planning

Another crucial aspect of investing life insurance money is tax planning. While life insurance death benefits are generally not taxable, the same cannot be said for other assets that may be included in your estate. By strategically planning your estate, you can minimize the impact of taxes on your life insurance proceeds and ensure that your beneficiaries receive the maximum amount possible.

Choosing the right ownership structure for your life insurance policy can significantly impact the tax implications. For example, placing the policy in an irrevocable life insurance trust (ILIT) can remove its value from your estate, potentially lowering estate taxes. Working closely with a financial advisor or estate planning attorney can help you navigate the complexities of tax planning and make informed decisions that optimize your tax benefits.

In addition to minimizing estate taxes, tax planning can also involve considering the potential income tax consequences for your beneficiaries. Understanding how your life insurance proceeds may be taxed and exploring options like designating specific beneficiaries, such as a spouse or charitable organization, can help reduce tax liabilities.

Overall, estate planning and inheritance are crucial elements when it comes to investing life insurance money. Legacy planning ensures that your life insurance money is used in the way you envision, while tax planning safeguards both your assets and your beneficiaries’ financial well-being. By taking the time to plan your estate and seek professional guidance, you can leave a lasting legacy and provide for your loved ones in the most efficient manner.

Consulting With Financial Advisors

Seeking Professional Guidance

When it comes to investing life insurance money, one of the best steps you can take is seeking professional guidance. Financial advisors can provide invaluable insight into how to make the most of your investment, ensuring that you optimize your returns while minimizing risks.

Consulting with financial advisors can help you navigate the complexities of the financial market and identify investment opportunities that align with your goals and risk tolerance. Their expertise can be instrumental in guiding you through the process of making informed and strategic investment decisions.

Exploring Investment Options

Before investing your life insurance money, it’s crucial to explore a diverse range of investment options. Working with financial advisors enables you to access a wide array of investment vehicles, including stocks, bonds, mutual funds, and other financial instruments.

Financial advisors can offer tailored recommendations based on your financial objectives and time horizon, ensuring that you select investments that align with your long-term plans. By leveraging their expertise, you can make well-informed investment choices that suit your unique financial situation.

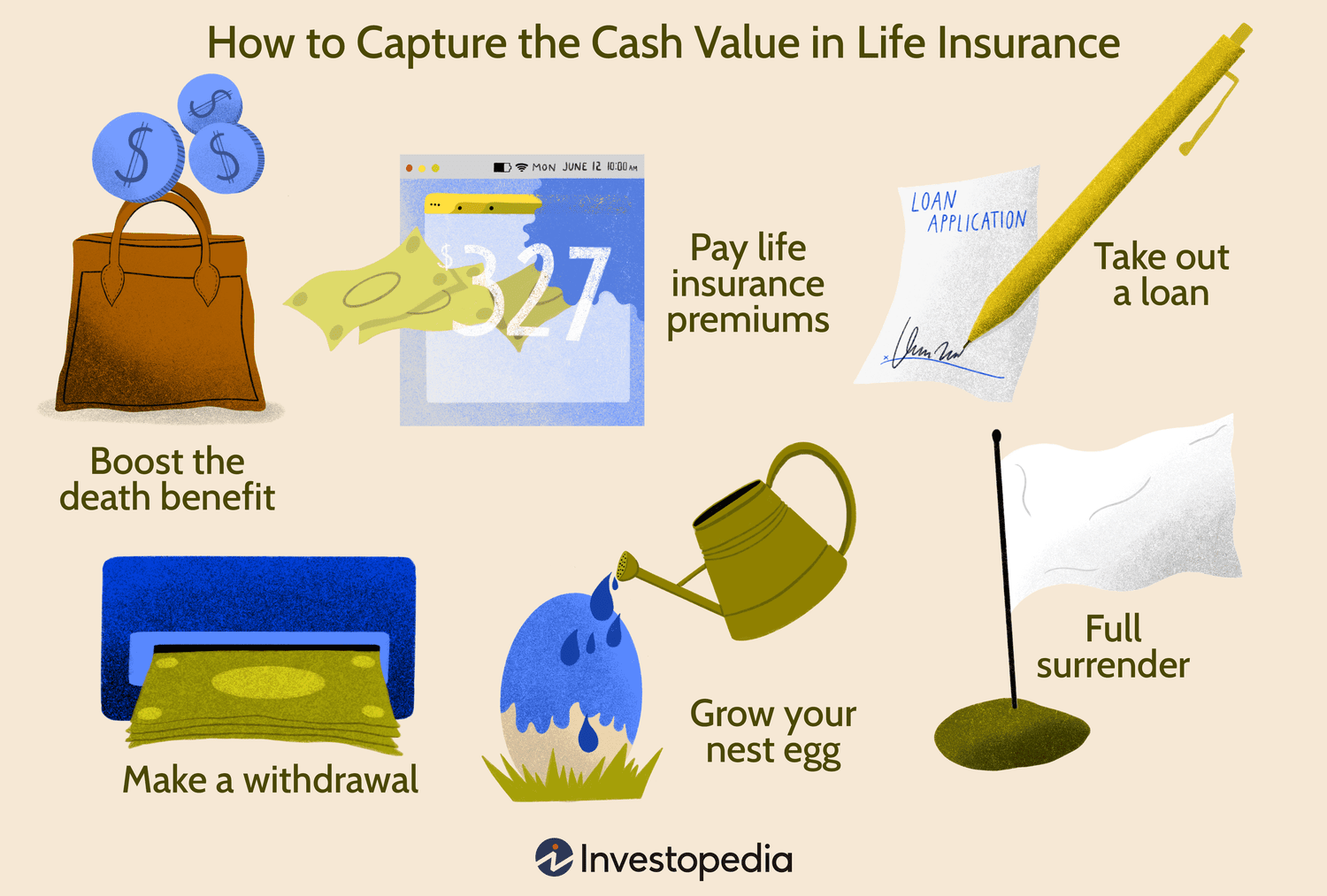

:max_bytes(150000):strip_icc()/How-can-i-borrow-money-my-life-insurance-policy_final-fa1474645da94b368bb3f5452392b0c0.png)

Credit: www.investopedia.com

Frequently Asked Questions Of Best Way To Invest Life Insurance Money

What Is The Best Way To Invest A Life Insurance Payout?

Investing in a diversified portfolio of stocks and bonds is a recommended strategy for life insurance payouts. Consider consulting a financial advisor for personalized guidance.

How Much Cash Is A $100 000 Life Insurance Policy Worth?

A $100,000 life insurance policy is worth the monetary value of $100,000. It provides financial security and support for your loved ones in the event of your passing. The payout can be used to cover funeral expenses, debts, and provide for your family’s future needs.

What Do Most People Do With Life Insurance Money?

Most people use life insurance money to cover funeral expenses, pay off debts, mortgage, or enhance their family’s financial security.

What Is The Best Way To Make Money With Life Insurance?

The best way to make money with life insurance is by investing in policies that offer cash value accumulation and earning potential. You can also consider selling life insurance policies through a brokerage or referral program to earn commissions. Exploring different options can help maximize your income potential.

Conclusion

When deciding how to invest life insurance money, it’s essential to consider your financial goals and risk tolerance. By diversifying your investments across different asset classes like stocks, bonds, and real estate, you can minimize risk and maximize returns. Don’t forget to regularly review your investment portfolio and make adjustments as needed.

Seek professional advice if you’re unsure about the best investment strategy. Stay informed and make informed decisions to secure your financial future.